What does it mean when the world’s most powerful central bank decides to “stand pat”? In this lesson, we examine the Federal Reserve’s recent decision to hold interest rates steady while signaling possible cuts later in the year. Learners will explore how economic policy, political pressure, and global uncertainty interact. This lesson is ideal for advanced learners interested in current events, economics, and public communication.

| Fed holds interest rates steady, signals rate cuts of 0.5% later this year |

Warm-up question: Have you ever been criticized or pressured to make a decision? How did you respond?

Listen: Link to audio [HERE]

Read:

MARY LOUISE KELLY, HOST:

The Federal Reserve is watching carefully to see if President Trump’s tariffs rekindle inflation. With that in mind, the central bank held interest rates steady today. Policymakers did signal they still expect to cut borrowing costs later this year. NPR chief economic correspondent Scott Horsley is in the studio. Hi, Scott.

SCOTT HORSLEY, BYLINE: Great to be here.

KELLY: Ah, great to have you with us. OK, so this was pretty much what we were expecting, watching for – the decision to keep rates where they are. There was still some drama, though, at today’s Fed meeting. What happened?

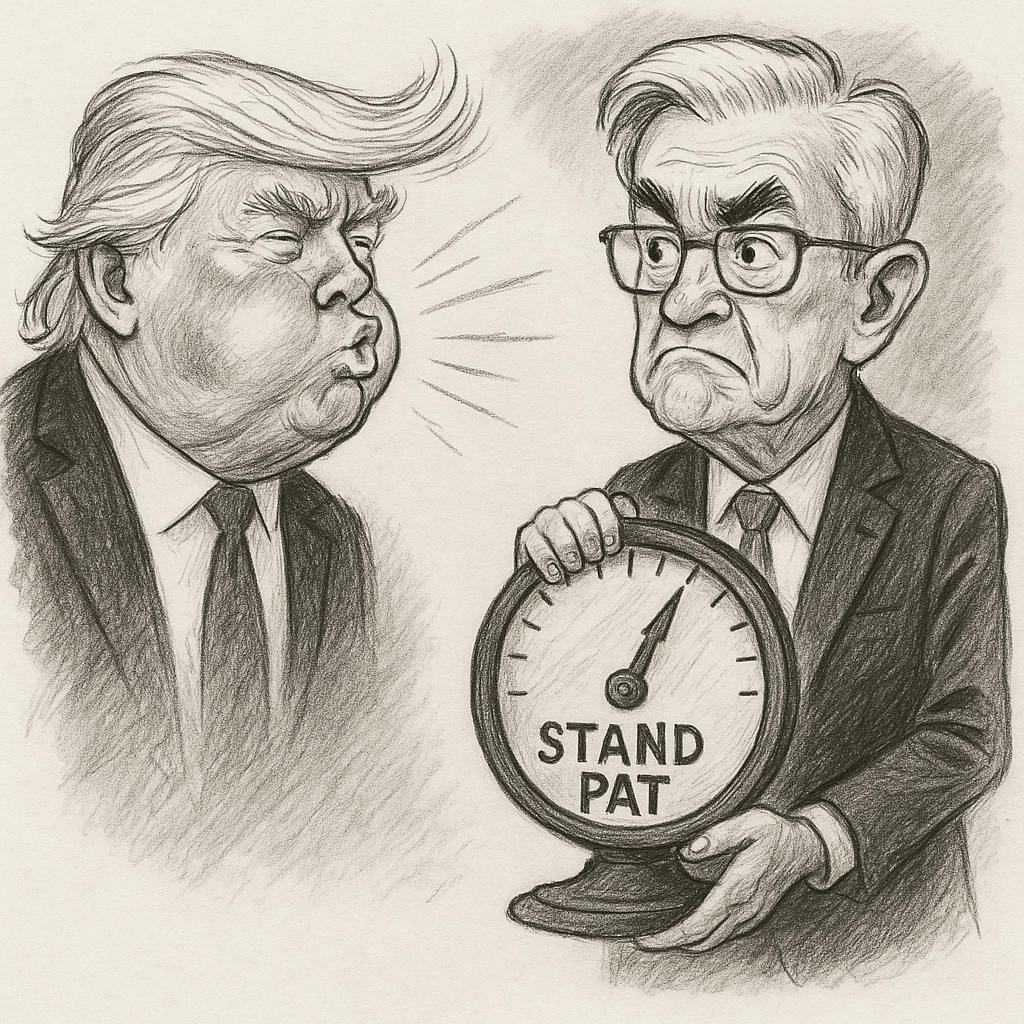

HORSLEY: That’s right. Every other Fed meeting, we get not only the interest rate decision, but a forecast of what Fed policymakers expect to happen in the future. And as you say, there was not a lot of suspense around the rate decision today. Markets were pretty sure the central bank was going to stand pat, but all eyes were on that forecast. And what it tells us is that Fed policymakers still expect to be in a position to cut interest rates later this year by an average of about half a percentage point. That would make it cheaper to buy a car or finance a business or carry a balance on your credit card. Fed Chairman Jerome Powell says we’re not there yet, but lower interest rates are in our future.

JEROME POWELL: It’s very, very hard to say when that will happen. We know that the time will come. As long as the economy is solid, though, as long as we’re seeing the kind of labor market that we have and reasonably decent growth and inflation moving down, we feel like the right thing to do is to be where we are, where our policy stance is, and just learn more.

HORSLEY: Yeah, the unemployment rate is quite low. It’s been 4.2% for the last three months, so there’s no real urgency to goose the economy by lowering rates.

KELLY: Although Scott, inflation has also been pretty tame for a few months now, isn’t that a reason to cut rates?

HORSLEY: Yeah, inflation has come down a lot from its peak, but, you know, the cost of groceries and big appliances is still going up faster than the Fed would like. And Powell and his colleagues are pretty sure we’re going to see higher inflation this year as a result of President Trump’s tariffs. You know, those import taxes are the highest in almost a century, and somebody has to pay that. Now, we haven’t seen a lot of evidence of the tariff effect in either the April or the May inflation reports. Prices in May barely budged, but Powell says that doesn’t mean we’re out of the woods.

POWELL: It takes some time for tariffs to work their way through the chain of distribution to the end consumer. A good example of that would be goods being sold at retailers today may have been imported several months ago before tariffs were imposed.

HORSLEY: The other wild card, of course, is what happens in the Middle East. The fighting between Israel and Iran has pushed oil prices up, and retail gasoline prices have started inching up here in the U.S. Powell says usually those kinds of spikes are pretty short-lived and don’t have lasting effects on inflation, but it is something the Fed’s keeping an eye on.

KELLY: Meanwhile, President Trump continues to needle the Fed. He wants them to lower interest rates. He is not going to let that go. Is it having any effect?

HORSLEY: Not yet – you know, the president has been very critical of Powell for not cutting rates more aggressively. Just this morning, Trump went on a lengthy tirade about the Fed chairman. He wants lower rates not only to boost the economy but also to make it cheaper for the federal government to finance its $36 trillion debt. You know, the interest on that debt alone is $776 billion this year, with four months to go in the fiscal calendar.

PRESIDENT DONALD TRUMP: It’s hundreds of billions – it’s even trillions of dollars that we’re going to lose because of this too late – I call him too late Powell ’cause he’s always too late.

HORSLEY: Now, Powell has shown a pretty thick skin and an ability to shrug off those attacks by the president, but Trump will have a chance to pick Powell’s successor when the Fed chairman’s term expires in just under a year.

KELLY: NPR’s Scott Horsley, good to see you.

HORSLEY: Good to be with you.

Vocabulary and Phrases:

- Rekindle: to restart or bring back a feeling or situation, like reigniting a fire or interest.

- Stand pat: to refuse to change one’s position or decision.

- Goose: to stimulate or boost something, especially the economy.

- Tame: to control or reduce something, like inflation.

- Budged: to move slightly or make a small change.

- Out of the woods: no longer in danger or difficulty.

- Inching up: slowly increasing or rising.

- To needle: to provoke or annoy someone repeatedly.

- Tirade: a long, angry speech.

- Thick skin: the ability to endure criticism or insults without being upset.

- Shrug off: to ignore or not be affected by something

Comprehension Questions:

- Why did the Federal Reserve decide to keep interest rates steady?

- What is the forecast for interest rates later this year?

- What impact do tariffs potentially have on inflation, according to the Fed?

- Why does President Trump criticize Jerome Powell?

- How has Powell responded to the president’s criticism?

Discussion Questions:

- Do you think public criticism can influence financial decision-making? Why or why not?

- Should the Federal Reserve consider political pressure when making policy? Explain.

- Can you think of a situation in your life when you had to “stand pat” despite pressure to change?